It’s safe to assume that each one of us once or continuously dreams of starting and growing our own businesses.

However, once you’ve identified where you should invest your hard-earned money, where do you start in establishing a business? Well, it should first start by having it legally registered. Your business should be registered with the Bureau of Internal Revenue (BIR), Department of Trade and Industry (DTI) or Securities and Exchange Commission (SEC).

Here are the steps on how to register your business with the said government agencies.

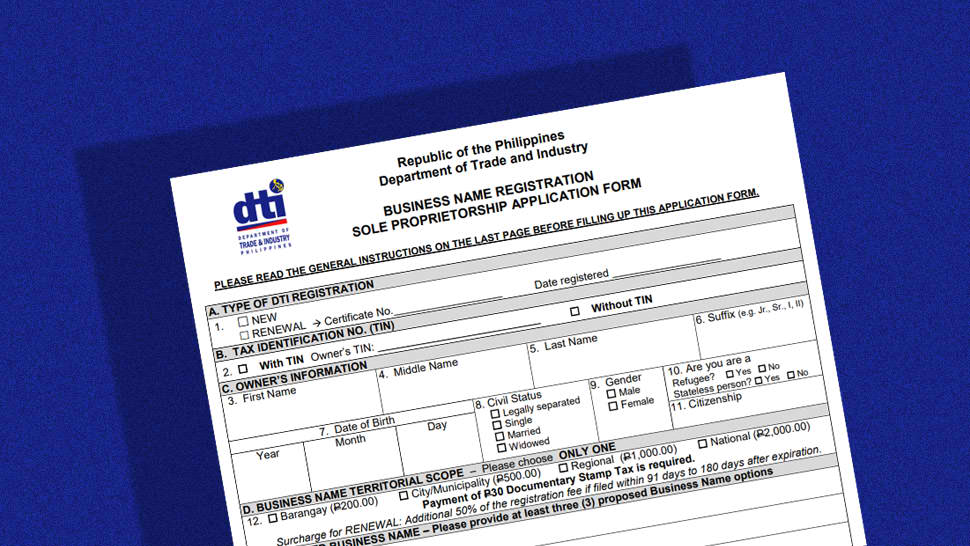

Registration with Department of Trade and Industry (DTI)

- For a single proprietor or sole owner, you first have to check the list of business names in the Philippine Business Registry website so you’ll know if your preferred business name(s) is still available.

- When you’re done checking, fill out the DTI Application Form available on their website.

- Before visiting DTI’s office, prepare three (3) business names and the following documents:

-

- Two (2) copies of completed application forms signed by the application; and

- Two (2) photo-bearing government-issued IDs.

- Once submitted, you’ll now have to pay for the registration and documentary stamp. Here’s a reference of registration fees that may depend on the territorial scope of your business:

-

- Barangay – PHP 200.00

- City or Municipality – PHP 500.00

- Regional – PHP 1,000.00

- National – PHP 2,000.00

Registration with Securities and Exchange Commission (SEC)

For partnership or corporation, registration should be done with SEC.

- Check if your proposed business name is still available in the SEC website. If available, you may reserve your company online. After which, you should confirm your company by visiting the SEC office within four (4) days.

- Before visiting the office, prepare the online application forms that can be found in the SEC i-Register and also bring along bring the following documents:

-

- Cover Sheet for Registration

- Reservation Payment confirmation

- Articles of Incorporation

- By-laws

- Other documents will also need to be submitted to the SEC depending on the type of business you’re looking to set up:

Partnership

- Domestic Partnership

- Foreign-owned Partnership

Corporation

- Domestic Stock Corporation

- Domestic Non-Stock Corporation

- Foreign-owned Corporation

- Foreign Corporation

You may call ((+63) 998-841-3548), email ([email protected]), or personally visit SEC for more details on how you can register your business successfully.

Application for a business’ Barangay Clearance and Mayor’s Permit

Before setting up a business, you’ll also need to obtain a Barangay Clearance as this will also be a requirement in obtaining a Mayor’s Business Permit. To obtain a Barangay Clearance, you should have the following documents:

- Original and photocopy of DTI or SEC certificate;

- Business location sketch or map;

- Contact of Lease (if you’re renting), or Land Title/Tax Declaration (if you own the place); and

- Filled out Barangay Clearance Application Form.

Do note that other documents may be required depending on the type of your business:

- National Food Authority (NFA) License for rice or corn and wheat dealers; or

- Bureau of Food and Drug Administration (BFAD) and Department of Health (DOH) for drugstores, bakeries, or other food and health-related businesses.

Registration with Bureau of Internal Revenue (BIR)

Of course, your business should be registered with BIR as well for tax purposes. Here are the steps on how you can comply with BIR:

- Download the following forms that can be found from the BIR website before visiting their office:

-

- BIR FORM 1901 – Application Form for Single Proprietors

- BIR FORM 1903 – Application Form for Partnerships and Corporations

- BIR FORM 0605 – Payment Form

- BIR FORM 2000 – Documentary Stamp Tax

- Bring the following documents to the BIR for your BIR business registration:

-

- Original and photocopies of DTI or SEC certifications;

- Mayor’s Permit;

- Contact of Lease (if you’re renting), or Land Title/Tax Declaration (if you own the place); and

- Business Location Map.

Upon issuance of your Taxpayer Identification Number (TIN), you should also receive a “Ask for Receipt” sign that you can post on your business’ establishment.

Leave A Comment